The Big Picture on High-Risk, High-Return Investments:

-

- Investing involves multiple dimensions beyond risk and return, including liquidity, time commitment, tax implications, and regulatory constraints, all of which shape investment decisions.

- High returns don’t always require high risk; by adjusting factors like liquidity and time horizon, investors can find opportunities that align with their financial goals while mitigating unnecessary risks.

- A well-rounded investment strategy considers diversification, recession resistance, and personal values, ensuring a portfolio that is not only profitable but also resilient and aligned with individual priorities.

Disclaimer

The information provided on this website is for general informational purposes only and should not be construed as legal, financial, or investment advice.

Always consult a licensed real estate consultant and/or financial advisor about your investment decisions.

Real estate investing involves risks; past performance does not indicate future results. We make no representations or warranties about the accuracy or reliability of the information provided.

Our articles may have affiliate links. If you click on an affiliate link, the affiliate may compensate our website at no cost to you. You can view our Privacy Policy here for more information.

When it comes to investing, conventional wisdom often tells us that high returns invariably come with high risk. However, this oversimplified view fails to capture the true complexity of investment decisions. As experienced investors and founders of Spark Rental and the Co-Investing Club, we’ve discovered that successful investing requires a more nuanced, multi-dimensional approach.

Beyond the Risk-Return Spectrum

Investment decisions extend far beyond the traditional risk-return spectrum. One crucial factor often overlooked is liquidity – your ability to access your invested funds when needed. While stocks and ETFs offer near-instant liquidity, other investments, such as real estate syndications, may lock up your capital for extended periods. This illiquidity isn’t necessarily a disadvantage; it’s simply a different dimension that needs to be considered in your investment strategy.

The time commitment dimension closely relates to liquidity. Many high-performing investments require patience, with holding periods ranging from three to seven years or longer. This extended timeline often allows investments to weather market fluctuations and realize their full potential.

Minimum investment requirements represent another crucial dimension. While some investments are accessible with just a few dollars, others might require substantial capital – anywhere from $50,000 to $250,000 or more. This barrier to entry doesn’t necessarily reflect the investment’s quality but rather its structure and target market. Through investment clubs and collaborative approaches, investors can often access these opportunities with lower individual contributions.

Regulatory Requirements

The regulatory landscape adds another layer of complexity. Many lucrative investment opportunities are restricted to accredited investors – individuals with either $1 million in net worth (excluding primary residence) or annual incomes exceeding $200,000 ($300,000 for married couples). This regulatory dimension can significantly impact your available investment options.

Tax implications form yet another crucial dimension. Different investment vehicles offer varying tax benefits. For instance, real estate syndications often provide advantageous tax treatment through depreciation and other write-offs, while note investments might generate regular taxable income. Understanding these tax implications can significantly impact your actual returns.

Diversification capabilities vary across investment types. Some investments offer built-in diversification, such as syndications owning multiple properties across different asset classes, while others might concentrate risk on a single asset. The ability to spread risk across multiple investments, properties, or sectors can significantly impact your portfolio’s resilience.

Recession-Proofing Your Portfolio

Speaking of resilience, recession resistance represents another vital dimension. Some investments perform remarkably well during economic downturns, while others might struggle. For instance, industrial properties with government contracts or essential service providers as tenants often maintain stability regardless of economic conditions.

Personal values and ethical considerations add yet another dimension to investment decisions. An investment might offer attractive risk-adjusted returns but conflict with your environmental, social, or governance principles. This dimension highlights how successful investing isn’t solely about financial metrics.

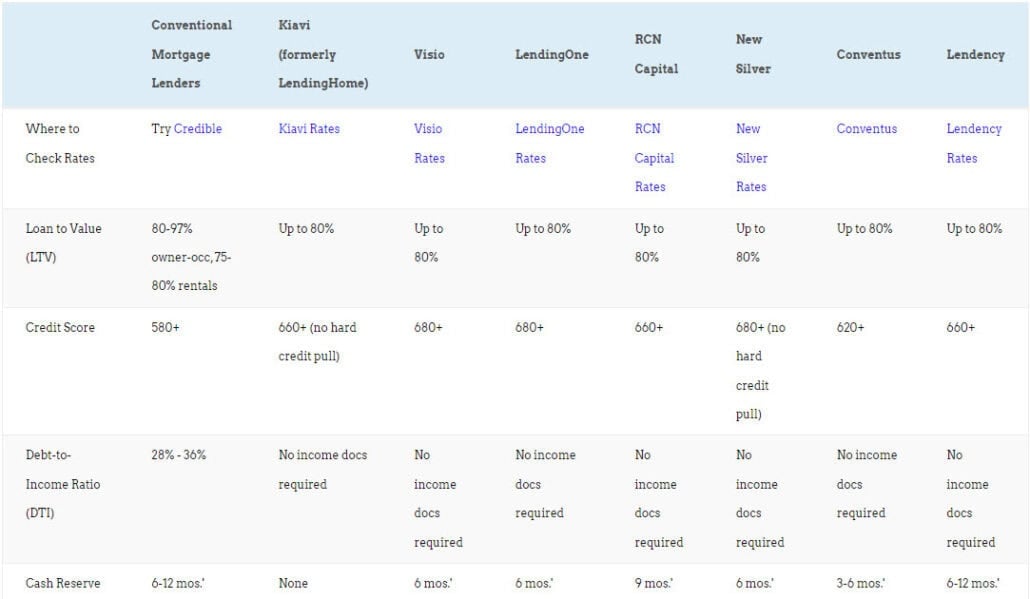

Want to compare investment property loans?

What do lenders charge for a rental property mortgage? What credit scores and down payments do they require?

How about fix-and-flip loans?

We compare the best purchase-rehab lenders and long-term landlord loans on LTV, interest rates, closing costs, income requirements and more.

Even risk itself is multi-dimensional, encompassing various types such as volatility risk, inflation risk, default risk, disaster risk, political risk, and concentration risk. Each type of risk requires different mitigation strategies and considerations.

Understanding these multiple dimensions of investing enables more informed decision-making. It reveals opportunities where high returns don’t necessarily require high risk, provided you’re willing to compromise on other dimensions like liquidity or time commitment. This multi-dimensional approach to investing helps create more resilient portfolios aligned with individual investor circumstances and goals.

Conclusion

Don’t let the oversimplified risk-return relationship limit your investment thinking. Consider all dimensions when evaluating investment opportunities, and you might find that the best investments for you don’t fit the traditional high-risk, high-return paradigm at all.

For those interested in learning more about passive investing strategies and applying these principles, we offer a free course at sparkrental.com/free. Remember, successful investing isn’t about finding the “perfect” investment – it’s about finding investments that align with your unique circumstances across all these dimensions.