HOA Facts And Figures 2025

HOA Managememt

JUNE 16, 2025

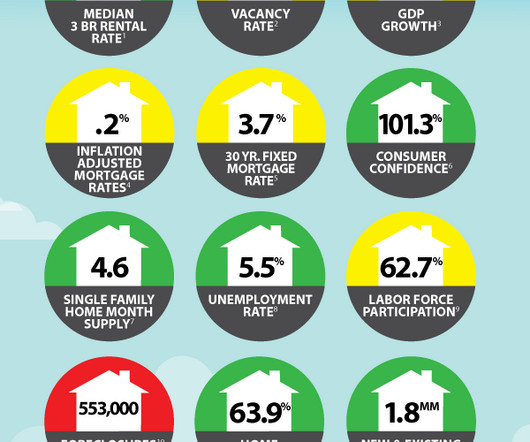

This means that when people refer to “HOAs,” they’re generally talking about the broader category that includes both single-family homes and condos. million homes located in HOAs, representing 37% of its total housing stock. Where HOAs Are Most Common HOA facts and numbers will vary greatly by region.

Let's personalize your content