Should You Convert Your Primary Home Into a Rental Property?

Authority Property Management

MARCH 14, 2025

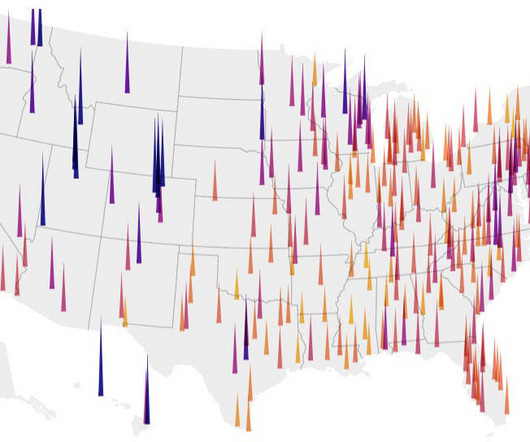

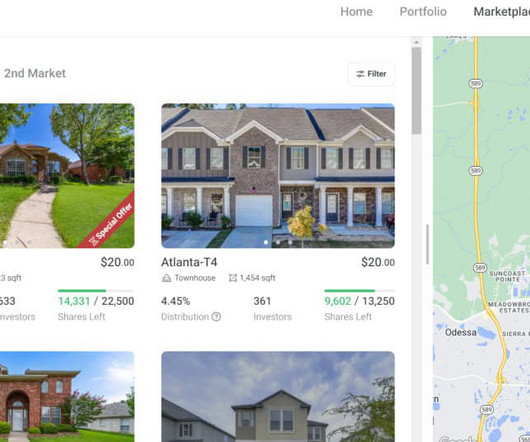

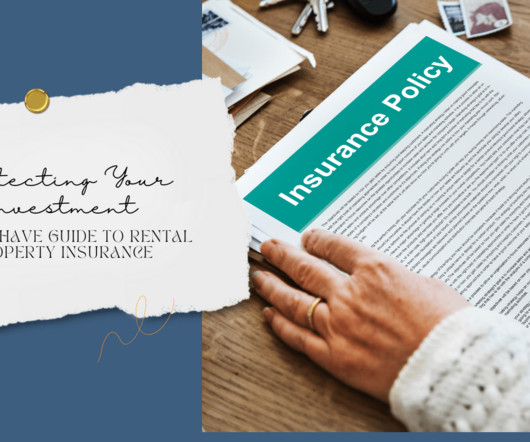

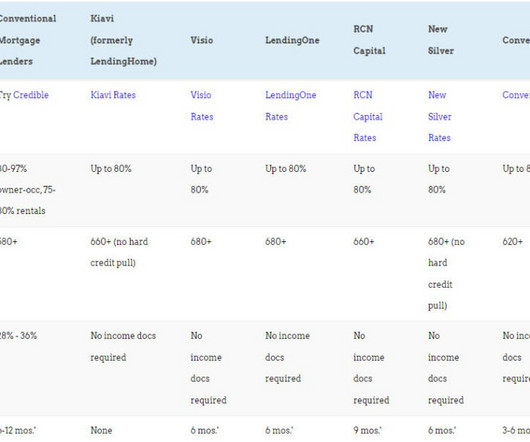

The answer depends on your financial goals, the local rental market , and how comfortable you are with being a landlord. From tax benefits to leveraging rental income for a new home loan, let's break down why converting your home into a rental might be a golden opportunity.

Let's personalize your content