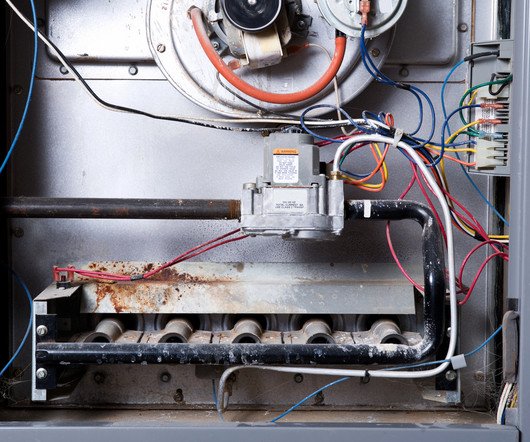

California Increases Dollar Limit for Home Repairs Without Licensed Contractors

Authority Property Management

FEBRUARY 1, 2025

Signed into law in September 2024, California Assembly Bill 2622 (AB 2622) introduces updates to the Contractors State License Law that directly benefit property owners and renters. AB 2622 raises the dollar threshold for contracting work that does not require a licensed contractor.

Let's personalize your content