Can You Deduct Your Own Labor on a Rental Property, Answered

Bay Property Management Group

FEBRUARY 26, 2025

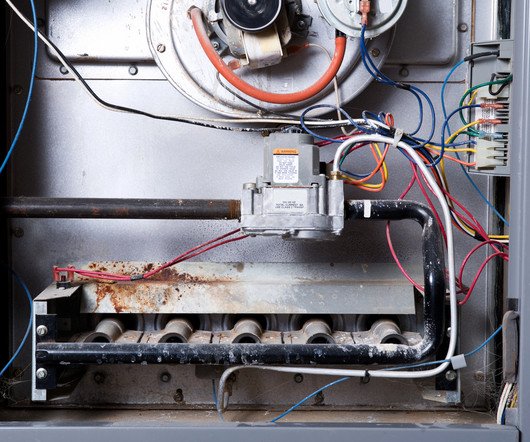

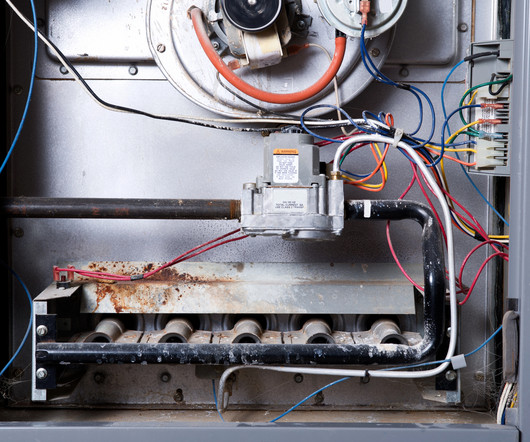

After all, hiring contractors is deductible, so shouldnt your own hard work count too? However, there are other ways you can save on your rental expenses, like contractor and material costs. The IRS only allows deductions for real expenseslike paying contractors, buying materials, or hiring property managers.

Let's personalize your content