What Is a Mother-In-Law Apartment & Should You Have One?

Bay Property Management Group

APRIL 22, 2025

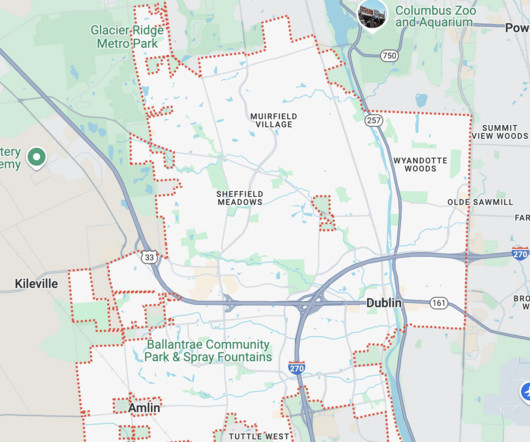

Local zoning laws, rental regulations, and permits dictate whether you can build and lease them , with size restrictions, occupancy requirements, and compliance with tenant rights laws varying by region. This process involves submitting detailed plans and undergoing inspections to ensure compliance with safety and design standards.

Let's personalize your content