Understanding and managing rental property maintenance emergencies—before it’s too late

Buildium

FEBRUARY 10, 2025

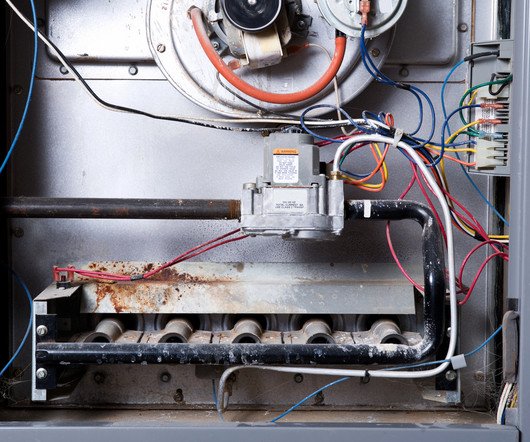

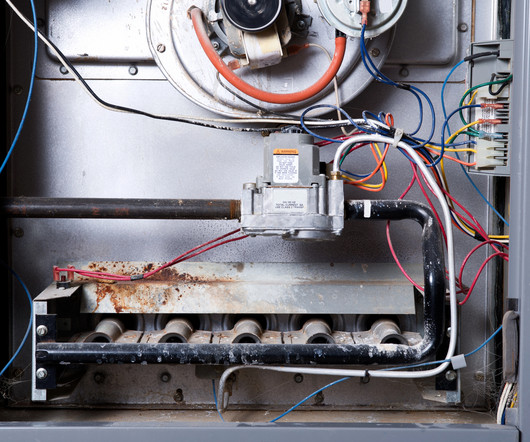

Your approach can significantly impact the profitability of each property in your portfolio, tenant satisfaction, relationships with your clients, and compliance with legal obligations. HVAC Failure Heating, Ventilation, and Air Conditioning (HVAC) systems are essential for tenant comfort and safety. Prioritize tenant safety.

Let's personalize your content