Boost Your Rental Income These Apps

Thanks For Visiting

JANUARY 28, 2025

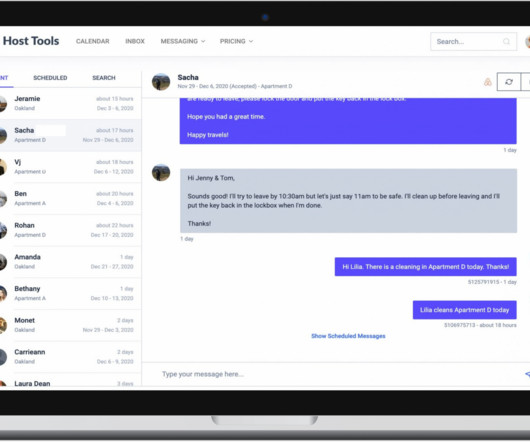

Skyrocket Your Rental Income With Our Favorite Airbnb Automation Apps As an Airbnb host, you know time is precious. Between managing bookings, guest messaging, and property upkeep, things can feel overwhelming. This frees you to concentrate on what matters: growing your rental business.

Let's personalize your content