How Does Airbnb Work?

Hospitable

JULY 15, 2025

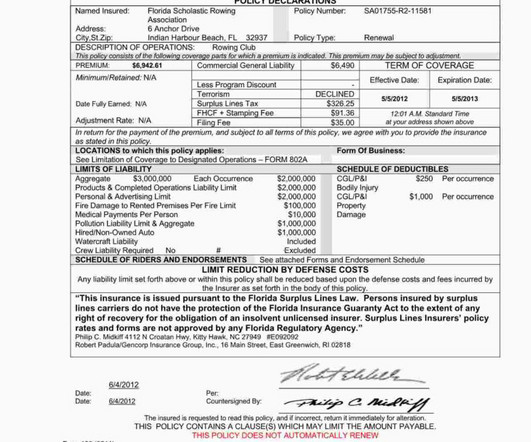

The company also launched Airbnb Services, featuring vetted professional service providers in 260 cities worldwide, to make guests’ stays more special. You may want to consider purchasing additional insurance. So, how does Airbnb work? How much money can you make?

Let's personalize your content