Multifamily property lease audits: Best practices for landlords

MRI Software

FEBRUARY 11, 2025

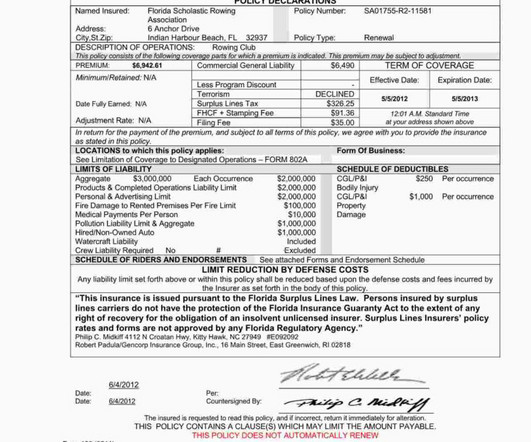

They allow landlords to identify discrepancies in rent payments, lease terms, or operational policies that could lead to financial risks. Check for key details like rent amounts, lease durations, tenant names, and signatures to ensure they align with your rent roll. What is the purpose of lease audits?

Let's personalize your content