Tenant Owes $21,000 in Late Fees: Court Rules in Landlord’s Favor

American Apartment Owners Association

JULY 31, 2025

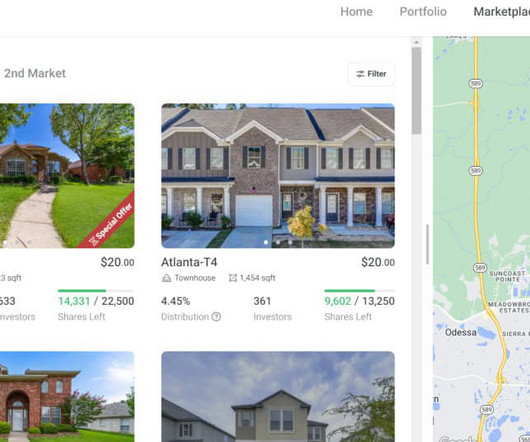

The case highlights the power (and potential risk) of enforcing daily late fee provisions in lease agreements. Foster had rented a single-family home from landlord John Schutt starting in 2018 for $1,900 per month. Their lease included a late fee clause charging $20 for each day that rent remained unpaid after the first of the month.

Let's personalize your content