Finding the Perfect Multifamily Property

American Apartment Owners Association

JANUARY 27, 2025

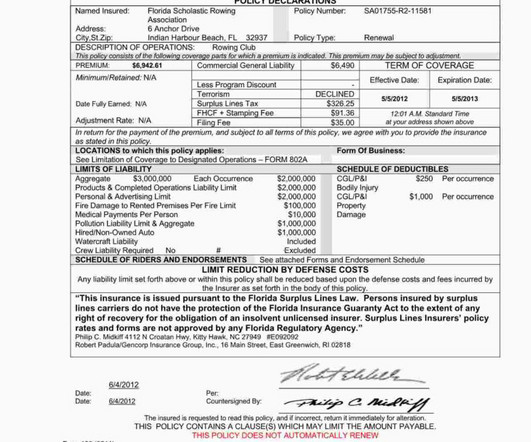

Operating costs can consist of property taxes, real estate agent fees, utilities, maintenance, property management fees, homeowners insurance and legal fees. Youll need to attract and retain quality tenants, establish rent collection processes, conduct regular maintenance and repairs and ensure compliance with local regulations.

Let's personalize your content