6 Property Management Software Platforms Approved By Matt and Jay

BetterWho

JULY 1, 2025

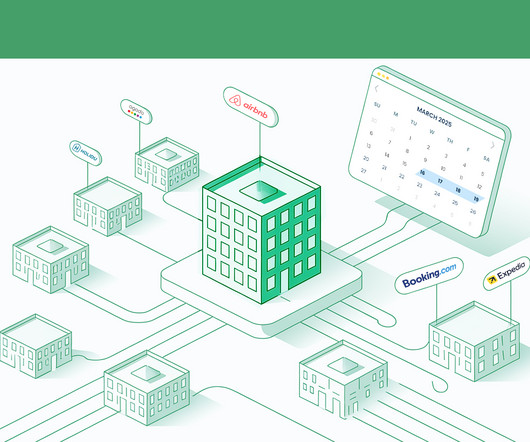

Why Software Alone Isn’t the Answer There’s no shortage of tech promising to simplify managing rental properties. But if you’re relying on software without strategic support, you’re probably missing out on growth. Book a free discovery call with our consulting team That’s where BetterWho comes in.

Let's personalize your content